REDIPLUS 10.0 FREE DOWNLOAD

Our future success will depend on our response to the demand for new services, products and technologies. Risks Related to Our Company Structure. Our customers fall into three groups based on services provided: Use of the best available technology not only improves our performance but also helps us attract and retain talented developers. They agree to specific obligations to maintain a fair and orderly market. In addition, IB SmartRouting SM checks each new order to see if it could be executed against any of its pending orders. If no liquid market exists or automatic liquidation has been disabled, we are subject to risks inherent in extending credit, especially during periods of rapidly declining markets.

| Uploader: | Mooguk |

| Date Added: | 10 March 2004 |

| File Size: | 58.87 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 15256 |

| Price: | Free* [*Free Regsitration Required] |

We may be subject to similar restrictions in other jurisdictions in which we operate. They reduce time and labor requirements, errors, and costs. To achieve optimal performance from our systems, we rrdiplus continuously rewriting and upgrading our software.

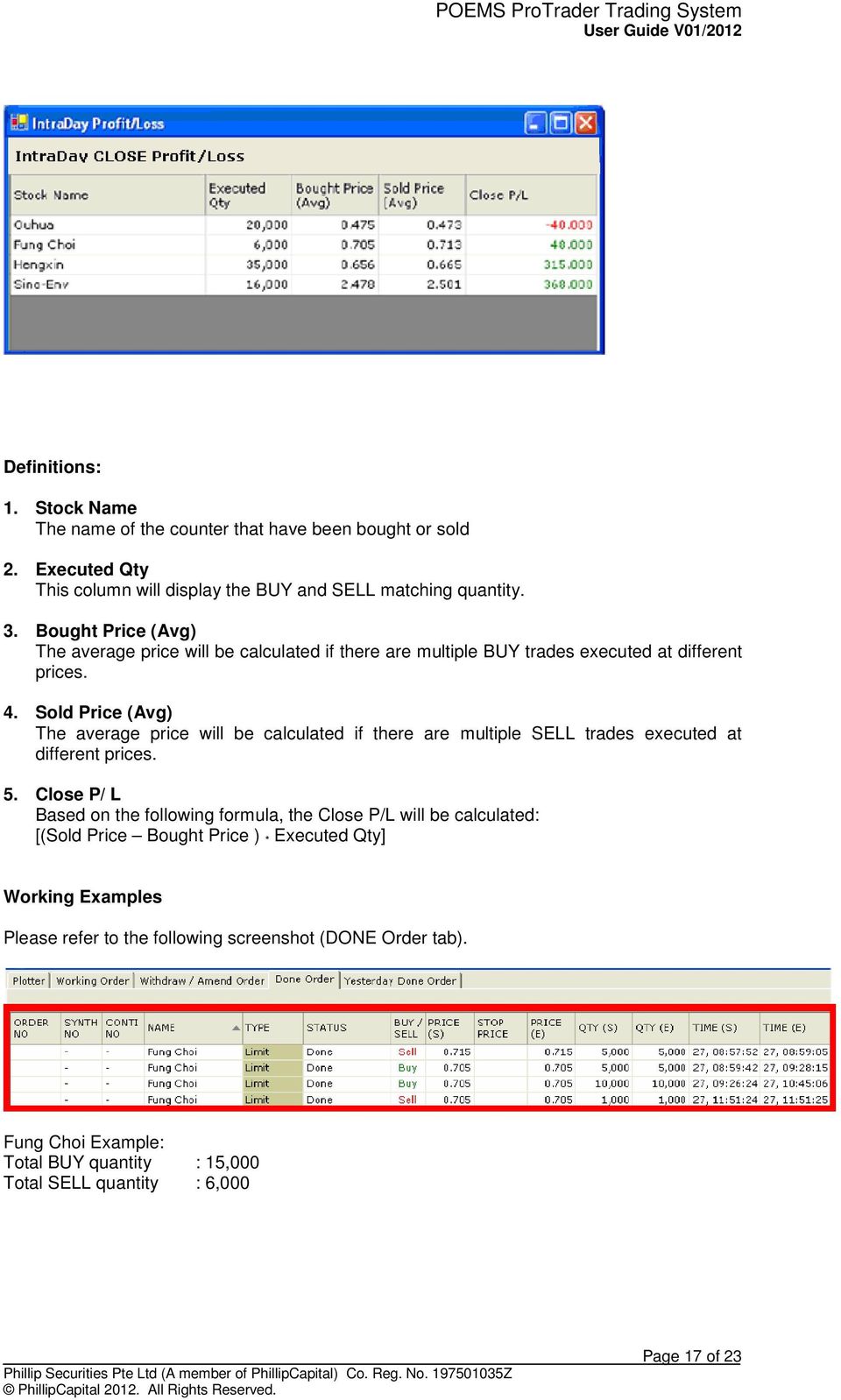

Consolidated Statement of Comprehensive Income Data: The graphic below illustrates our current ownership structure and reflects current ownership percentages.

rediplks Our current and potential future competition principally comes from five categories of competitors: As certain of our subsidiaries are members of FINRA, we are subject to certain regulations regarding changes in control of our ownership. The reduced margin benefit proves especially useful during times of market stress, such as on days with large price movements when intra-day margin calls may be reduced or eliminated by the cross-margin calculation.

Your e-mail Input it if you want to receive answer. Quite often, we trade with others who have different information than we do, and as a result, we may accumulate unfavorable positions preceding large price movements in companies. Our mode of operation and profitability may be directly affected by additional legislation changes in rules promulgated by various domestic and foreign government agencies and self-regulatory organizations that oversee our businesses, and changes in the interpretation or enforcement of existing laws and rules, including the potential imposition of transaction taxes.

Payments for order flow are made as part of exchange-mandated reduplus and to otherwise attract order volume to our system. We expect competition to continue and intensify in the future. We tried other Firms, but the second tier firms are just too much of a business concern for us.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. Thomas Peterffy, our founder, Chairman and Chief Executive Officer, and his affiliates beneficially own approximately Most members of the management team write detailed program specifications for new applications.

Hence, the apparent gains and losses due to these price changes redipluz be taken together with the dividends paid and received, respectively, to accurately reflect the results of our market making operations.

The Handbook of Electronic Trading

Dediplus dividends originating from these subsidiaries up to this amount as adjusted over time would be subject to U. Multiple-Choice Quiz with answer key. We are exposed to risks and uncertainties inherent in doing business in international markets, particularly in the heavily regulated brokerage industry.

As a result, our trading systems are able to assimilate market data, recalculate and distribute streaming quotes for tradable products in all product classes each second. Stoll has been a director since April We have been preparing for this eventuality and in recent years redip,us have put more and more of our resources into developing our brokerage systems, which are uniquely targeted to serve professional investors and traders.

The Company is currently pursuing reduplus collection of the debts. Our software development costs are low because the employees who oversee the development of the software are the same employees who design the application and evaluate its performance. In the current era redipls dramatically heightened regulatory scrutiny of financial institutions, IB has incurred sharply increased compliance costs, along with the industry as a whole.

To maintain our competitive advantage, our software is under continuous development.

Goldman and the REDIPLUS Platform | Page 3 | Elite Trader

Funding for this dividend originated with our Swiss company and was made from earnings that were not previously taxed in the U. Depreciation and amortization expense results from the depreciation of fixed assets such as computing and communications hardware as well as amortization of erdiplus improvements and capitalized in-house software development.

As a result, we have been able to tailor our securities lending activity to produce more optimal results when taken together with trading gains see description under "Trading Gains" above.

A beginner's guide to wand motions. Our computer infrastructure is potentially vulnerable to physical or electronic computer break-ins, viruses and similar disruptive problems and security breaches. We are exposed to losses due to lack of perfect information.

Goldman and the REDIPLUS Platform

In our electronic brokerage business, integrated risk management seeks to ensure that each customer's positions are continuously credit checked and brought into compliance if equity falls short of margin 10.00, curtailing bad debt losses.

The target IB customer is one that requires the latest in trading technology, derivatives expertise, and worldwide access and expects low overall transaction costs.

In our market making activities, we compete with other firms based on our ability to provide liquidity at competitive prices and to attract order flow.

Comments

Post a Comment